Once a vehicle driver does find SR-22 insurance coverage, they will still need to pay higher rates contrasted to a common auto insurance plan - insurance group. Non-Owner SR-22 Insurance Policy in Wisconsin, Your driving permit can obtain suspended in Wisconsin if you have a driving offense such as a speeding ticket, a DUI or any other major website traffic infraction on your document. driver's license.

sr22 insurance dui credit score car insurance vehicle insurance

sr22 insurance dui credit score car insurance vehicle insurance

sr22 coverage deductibles car insurance insure sr-22

sr22 coverage deductibles car insurance insure sr-22

This guideline uses even if you do not have a car. Non-owners SR-22 insurance policy makes it feasible for vehicle drivers that regularly rent out vehicles or obtain autos from buddies or household to save cash on their vehicle insurance coverage expenses. credit score. According to Money, Nerd, the average price of non-owner insurance in Wisconsin is $417 each year.

Second to USAA is GEICO, with a typical expense of $280 each year. Scroll for a lot more The rates utilized to identify the ordinary cost of non-owner automobile insurance coverage in Wisconsin are for drivers with a DUI on their document. The policies cover a physical injury obligation coverage of $50,000, $100,000 in bodily injury liability per mishap and also a residential property damages responsibility restriction of $50,000 per crash.

insurance insurance group vehicle insurance auto insurance sr-22 insurance

insurance insurance group vehicle insurance auto insurance sr-22 insurance

Broaden ALLWhat Wisconsin motorists need an SR-22? Wisconsin motorists who have actually devoted a major website traffic infraction require to have an SR-22 certificate filed on their behalf - motor vehicle safety. This filing shows to the state that your cars and truck insurance policy fulfills the federal government's minimum responsibility coverage needs. Where can Wisconsin chauffeurs get an SR-22? Your automobile insurer is called for to electronically submit an SR-22 kind to license you.

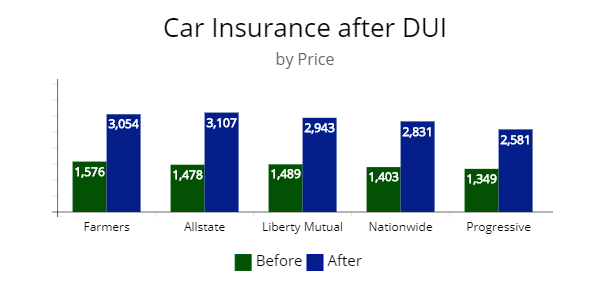

For low-cost SR-22 insurance protection in Wisconsin, be certain to shop around to discover competitive rates. Is SR-22 pricey in Wisconsin? In Wisconsin, a minimal vehicle insurance plan for tidy drivers costs $473 per year, usually. On the other hand, the cost of SR-22 insurance policy with minimum DUI insurance coverage is an ordinary annual price of $958.

About What's Sr-22 Insurance? Will I Need It After An Arizona Dui?

Quotes were collected for plans that meet the state's minimum coverage demands as well as for full protection plans with $100,000 in physical injury liability insurance per individual, $300,000 in bodily injury responsibility insurance coverage per crash and also $100,000 in residential property damages obligation per mishap. Prices are for the very same driver with both a clean record as well as a DUI - ignition interlock.About the Writer (insurance).

no-fault insurance motor vehicle safety insure sr22 sr22 insurance

no-fault insurance motor vehicle safety insure sr22 sr22 insurance

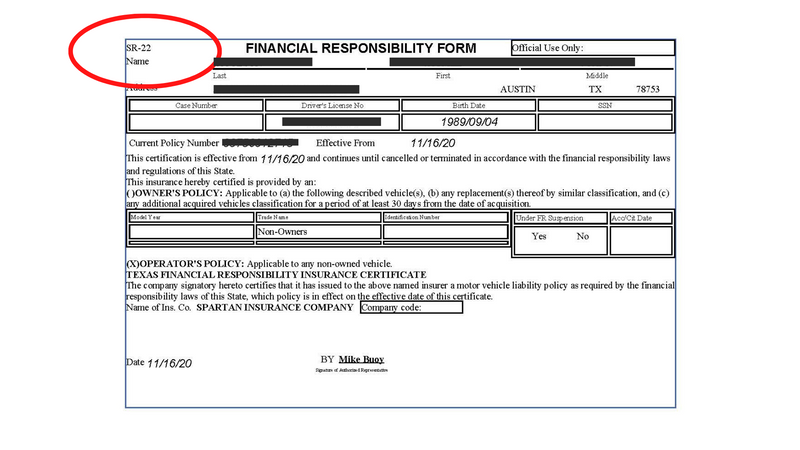

When you get a DUI sentence, you can expect your automobile insurance rates to rise (car insurance). But what you may not know is that you should offer proof to the State of Nevada that you have vehicle insurance after a driving under the influence sentence. The Nevada Division of Motor Vehicles requires motorists to complete and send form SR-22 through their insurance provider.

Here's what you require to find out about how to submit type SR-22 after a Drunk Driving in Nevada. 1. What Is Insurance Type SR-22 in Nevada? Form SR-22 is a type that verifies that you have car insurance. sr22 coverage. It's a kind that you submit with the Nevada Department of Motor Cars to confirm that you have vehicle insurance - no-fault insurance.

The Nevada Department of Motor Autos requires you to submit the kind before they renew your vehicle driver's license. 2. Just how Do I Get Insurance Policy Kind SR-22 in Nevada? Your insurer has form SR-22. They need to have the form and understand just how to file it with the State of Nevada Department of Electric Motor Vehicles when you ask.

You can inspect with your insurance company and also the Division of Motor Cars if you have concerns about whether you comply. If you shed or cease your auto insurance when you need to file an SR-22 form in the State of Nevada, the insurance business informs the Division of Motor Vehicles utilizing form SR-26 (liability insurance).

Some Known Facts About Getting Insurance After A Dui - Sr-22 Adviser.

The DMV sends you a warning notice. If you're not able to show that you have brand-new insurance coverage in 10 days, the DMV suspends your permit. It's illegal to drive without the called for insurance coverage minimums in the State of Nevada, so if you drive without insurance, you breach the regulation. auto insurance.

Do I Still Need To File Form SR-22 If I Decide Not to Possess a Vehicle After a DRUNK DRIVING? Yes, you still need to submit type SR-22 after a drunk driving also if you choose not to possess an electric motor automobile. sr22 insurance. The only method to get a valid license in Nevada after a DUI is to file form SR-22 - ignition interlock.

You may select not to have a valid license and also not file the form, but filing form SR-22 is the only means to bring back a legitimate motorist's permit after a drunk driving sentence in the State of Nevada. You submit form SR-22 in Nevada after your permit suspension period ends. sr-22 insurance.

For a first driving under the influence conviction, your suspension is three months. For a second sentence, the suspension duration is one year. For a 3rd sentence, your license is put on hold for 3 years (sr-22). After you wait out the period of suspension, you can submit form SR-22 and also take various other needed actions to reinstate your driver's permit.

Can I Obtain a License in One More State If My Nevada Motorist's License Is Suspended? No, you can not get a license in an additional state if your Nevada driver's permit is put on hold. Each state needs you to be totally cost-free of all various other suspensions before you qualify to obtain a valid permit - credit score.

See This Report about Mandatory Insurance Faqs - Missouri Department Of Revenue

division of motor vehicles insurance sr22 insurance ignition interlock car insurance

division of motor vehicles insurance sr22 insurance ignition interlock car insurance

While you may fool a state into issuing you one more permit, that Learn more here certificate isn't really valid up until you clean up suspensions from one more state (sr22). When the new state finds out concerning your prior suspension, you can anticipate to deal with fees for driving on a put on hold permit. 10. Exists Any Type Of Method to Prevent Having to Submit Kind SR-22 After a Nevada drunk driving? The very best means to avoid needing to submit form SR-22 after a Nevada DUI is to stay clear of a DUI sentence and certificate suspension.